In a major boost for Nigerian cardholders, three leading commercial banks—United Bank for Africa (UBA), Wema Bank, and Guaranty Trust Bank (GTB)—have reinstated international transaction capabilities on their naira debit cards.

This development marks a return of cross-border payment flexibility for customers, nearly three years after the service was halted due to foreign exchange (FX) constraints.

UBA announced that its Premium Naira Cards, including Gold, Platinum, and World variants, are now enabled for international purchases. The bank assured customers of enhanced access to global payments, online shopping, POS usage, and ATM withdrawals abroad.

“If you haven’t used your card recently, now’s a great time to rediscover the convenience and prestige that comes with being a UBA premium cardholder,” UBA stated.

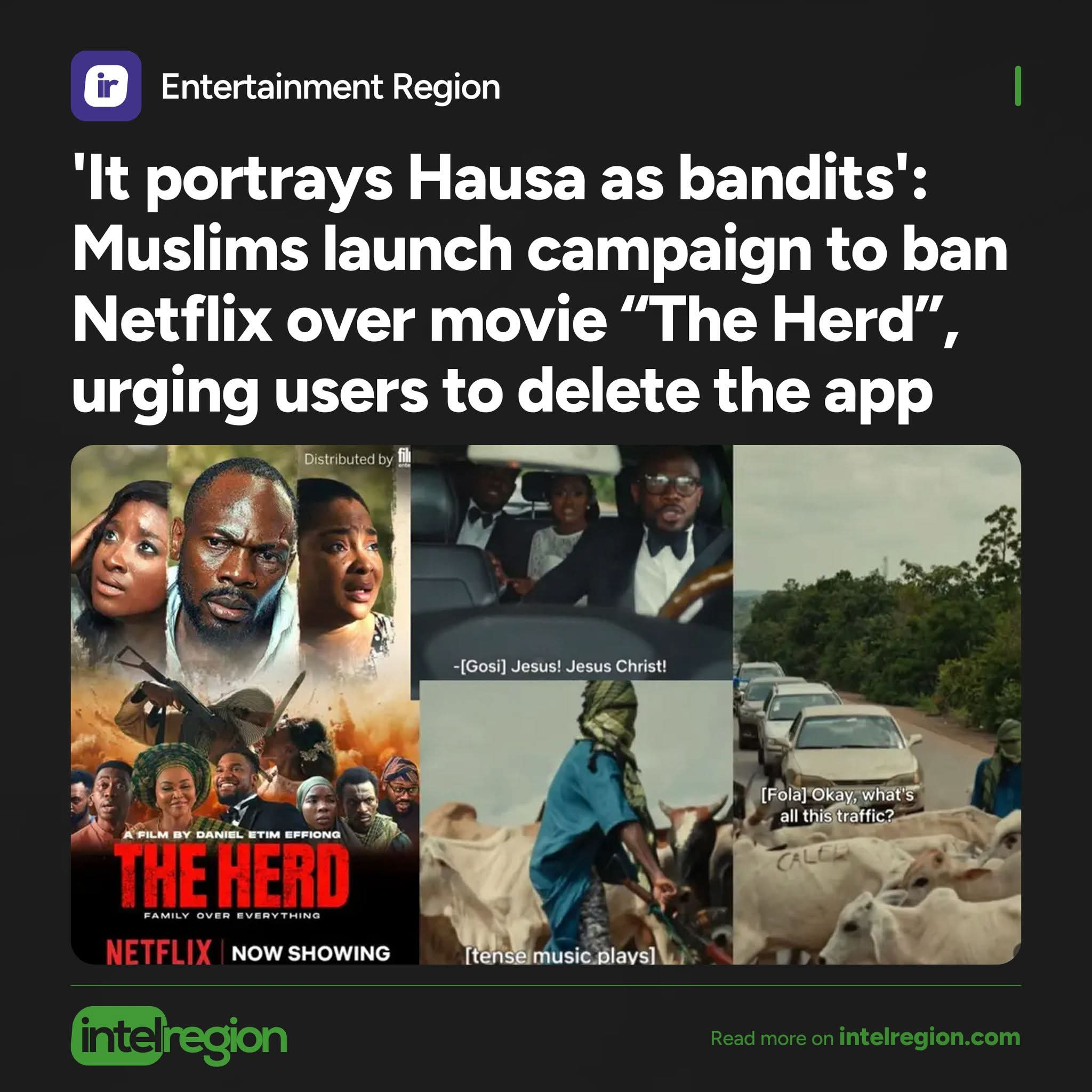

Wema Bank also reactivated its naira Mastercard for global use. In a promotional message, the bank highlighted that customers can now “pay in dollars” on platforms like Amazon, Netflix, Spotify, and AliExpress using their naira card.

GTBank, in a separate customer email, confirmed the reinstatement with a $1,000 quarterly spending limit on its naira card. This includes:

-

ATM withdrawals abroad: $500 per quarter

-

Online and POS transactions: $1,000 combined quarterly cap

GTBank emphasized that all international transactions—including cash withdrawals, foreign site payments, and overseas POS purchases—must fall within this total $1,000 quarterly limit.

Why Banks Are Reactivating Naira Cards for Global Use

Experts attribute the policy shift to a more stable FX market and narrowing gap between official and parallel exchange rates.

According to Ayokunle Olubunmi of Agusto & Co, “The improved liquidity in the FX market and reduced arbitrage opportunities supported banks’ decision.”

Charles Sanni, CEO of Cowry Treasurers, echoed similar sentiments, noting that Nigeria’s currency appreciation, rising diaspora remittances, and restored confidence in FX policies under the Central Bank of Nigeria (CBN) played a role.

“Improved credit ratings, cleared FX backlogs, higher oil prices, and bank recapitalisation also influenced the banks’ decision,” Sanni added.

Background: Why Banks Suspended the Service

In 2022 and early 2023, banks including Standard Chartered, FirstBank, Zenith Bank, and GTBank suspended international usage of naira cards due to Nigeria’s FX crisis. The scarcity of dollars and pressure on reserves forced institutions to restrict dollar-denominated transactions.

Fintech platforms like Flutterwave and Eversend also halted their virtual card services for global payments during this period.